Abstract

“Financial Technology” or “Fintech” is becoming a global phenomenon, refers to employing the use of technological methods in bettering financial customer relationships and delivering financial services. This term can be traced back to the “Financial Services Technology Consortium”, a project initiated by Citigroup, the mission of this project is to facilitate technological cooperation efforts. “FinTech” now is referring to a large and rapidly developing industry, therein 48 fintech unicorns are now worth over US$187 billion, according to UppLabs (2018). In this study, the Fintech and TechFin business model is examined in detail, and their companies operating in the field of financial technologies depend on properly cooperating with each other to complement mutual shortcomings on the partial competition in the long term.

Keywords: Fintech, TechFin, Financial Technologies, Fintech versus TechFin

1. Introduction

FinTech nowadays is always seen as a unique marriage of financial services and information technology. However, the interlinkage of finance and technology determined various business models of FinTech phases. In fact, the 2008 Global Financial Crisis was a watershed in the evolution of financial technology and is part of the reason FinTech is now evolving into a new paradigm. The evolution poses a different pattern in the finance industry, and brings challenges for regulators and market participants, especially in balancing the potential benefits of FinTech innovation with potential market risks.

The article compares two phases in the FinTech history: FinTech and TechFin by using two examples – Monzo and Ant Financial Service platform, and outlooks on the evolution of the financial technology sector. Also, we consider the regulatory implications of its growth and the future trend of FinTech, discussing the future innovation trend and possible regulatory challenges.

2. The History of Financial Technology

Financial technology (FinTech) has been visibly evolving in front of the public’s eyes ever since digital banking emerged. In an increasingly cashless society, applications and digital platforms are formed to help us better understand and manage our finances. Simply, fintech is just applying technology to improve financial activities.

Arner et al. (2016) stated that fintech can be split into three (and a half) eras, each era witnessed a change between customers and their money in the market. The FinTech 1.0 stage refers to building the infrastructure supporting globalized financial services, which is between 1886 and 1967. FinTech 2.0 stage start with the installation of the first ATM by Barclay in 1967, and FinTech 2.0 is a process switching from analogue to the digitalization of finances. In this phase, the digital payment systems came as the world gradually went online, such as PayPal. A particular bust – the global financial crisis of 2008 – was a milestone for the birth of FinTech 3.0 and boost the subsequent innovation. Mobile devices become the primary accessing the web and online financial services as smartphone adoption in this stage. Even the established bank started to brand themselves as start-ups, it is an era of the start-up. With the advent of new technologies, creating digital banking become easier by using Open Banking, digital banks that have emerged based around improving customer experience, Banking as a Service (BaaS) platform. Arner et al. (2016) believed the next stage of fintech 3.0 is fintech 3.5, which has been defined as the situation between customer behaviours and the internet in developing countries, symbolling the advances that are being made in digital banking globally.

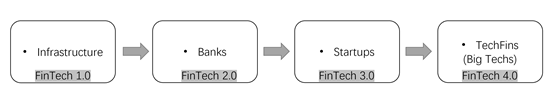

According to Elgin (2019), the four steps of historical development processes in FinTech are shown (Figure 1). Generally, the FinTech we mentioned nowadays is FinTech 3.0, and he provided that fintech 4.0 is the stage we called TechFin. In this article, the fintech mainly refers to the startups in FinTech 3.0 stage, and TechFin mainly refers to financial institutions based on BigTech in FinTech 4.0, according to the Elgin (2019) research.

Figure 1. The Evolution of FinTech

Source: (Elgin,2019)

3. Literature review

3.1 Fintech

The Fintech industry began in the 1950s with the birth of the ATM and credit cards, which is not a 21st century innovation (Zheng, 2019). KPMG’s (2018) Fintech Pulse report stated that global fintech investment increased from $50.8 billion in 2017 to $111.8 billion in 2018, more than doubling, with an unprecedented number of deals through multiple channels. According to Susan Moore(2017), the ongoing noise caused by FinTechs have affected traditional banks whether FinTechs are going to ban all traditional financial organizations or not. According to Deloitte, the competitive advantages of FinTechs is mostly from their agile structure, loose regulation, and personalized service approach. Although their competitive advantages, small Fintech startups have ineligibility to handle regulatory issues such as General Data Protection Regulation (GDRP), which presented by Europe in May 2018 (Lewis, 2021). Also, cyber-attack risk is a severe concern for FinTechs, since cyberattacks lead to high costs on reestablishment and the destructive loss of public trust. Besides, lack of expertise and low band recognition are current issues FinTechs need to solve (Vohra, 2020).

Regularly, World Economic Forum defines fintech as companies that offer or optimize financial services by applying technology. Another definition of FinTech is from PwC (2016), fintech is a dynamic market segment at the intersection of the financial services and technology sectors, technology-focused start-ups and new entrants of the market innovate the financial products and services at present offered by the established financial services industry. As a result, fintech is gaining enormous momentum and disrupting traditional value chains. Also, Gartner (2017) defines fintech as startup technology providers delivering merging tech to approach financial services in innovative ways or essentially change the way banks’ business models are created and distributed and generate further value.

3.2 TechFin

A Fintech disruptor emerged from the technological industry: TechFin (or Bigtech) (Bada, 2020). TechFin is contract of two words: technology and finance. As Economist noted, TechFins are tech-based companies who embed financial services to make their own products more attractive. Unlike FinTech, according to Awasthi (2022), TechFins have well-versed technology, market resources, a large amount of customer information and data to analyze, giving TechFins advantages over FinTechs and traditional financial institutions. In the past several years, GAFA (Google, Alipay, Facebook, Apple) have dominated to become the biggest Techfin establishment providing financial services around the world (Aron,2021). In the coming years, TechFins are projected to surpass FinTech establishments as their huge customer database and mature technology. Aron (2021) predicted that integrating TechFins and FinTechs is the future trend since both are certainly aimed at bringing a faster, better, and more efficient mode of managing customer finances. However, the TechFin firms have their limitations.

3.3 The Financial Environment of FinTech and TechFin

According to PwC (2016), more than 20% of financial service business is at risk to Fintech. Philippon (2016) discussed the potential effects of FinTechs in the financial industry and stated that FinTechs will make a profound impact on the traditional financial industry. Up to 2017, 82% of the traditional financial service companies expect to increase FinTech partnerships in the next three to five years, whereas 88% of financial services are concerned their revenue is at risk to FinTechs. Puschmann (2017) defined FinTechs as a level of evolution observed in the digitization process and concluded that changing the role of IT, changing consumer behaviour, changing ecosystems and changing regulations are determinants of this evolution. He emphasized that the key has shifted from intra-organizational solutions to inter-organization approaches. Mention, A.-L. (2019) stated that fintech startups are disrupting the incumbent banking system with faster, cheaper, and better service models. She pointed out that FinTechs are becoming an alternative to the traditional bank system. Gilbert (2022) argued that digital-only startups would occur customer concerns, meanwhile, old names in the financial industry are attempting to gain a foothold in financial upstarts by investing. For instance, Visa launched an investment fund for fintech startups and it is expected to add weight to Visa’s thrust in the digital banking market (MarketWatch, 2020), going into a partnership is another option.

4. FinTechs and TechFin (Big Tech)

Fintech and TechFin as two models in the evolution of financial technology have a different emphasis. Fintech applies technology to improve financial activities, its mission is to digitize the financial service industry. TechFin companies embed financial services to make their own products more attractive, but their business model does not depend on margin in those financial services. In this part, I will state the general features of FinTech and TechFin, and illustrate the differences between FinTech and TechFin in two cases, Monzo and Alipay (Ant Financial Services Group).

4.1 Monzo and FinTech

Monzo, is an online bank based in the United Kingdom and one of the earliest fintech in the UK, according to Cho (2016). Throughout Monzo’s history, Monzo use agile methodologies to evaluate the requirements, plans, and results take place continuously, so we can conclude that Monzo is dedicated to innovative financial services and developing their product based on “customer-centric”. Also, Monzo owns its significant digital infrastructure, its transactional database is using the open-source data called Apache Cassandra, with its application code written in Go, an open-source programming language. The bank uses AWS CloudTrail, which could provide API call historical data to enable security analysis, resource change tracking, and compliance auditing, along with the AWS CloudHSM service for its crypto keys. Besides, Monzo provides various financial services through its mobile platform. Monzo’s business model has been shown in the following business canvas (Figure 2.)

Figure 2. The Monzo’s Business Model

Source: Author

Fintech is formed from that finance firms lift efficiency and innovation to their financial service by relying on technologies, such as Artificial Intelligence (AI), Cloud Computing, BlockChain, Application Programming Interface (API), and Big Data. Therefore, FinTech owns wide information resources with an open-source database, including fresh but targeted information, precision to capture customers’ requests and design personalized financial products. Meanwhile, fintech could achieve digital management based on big data and AI tech, to analyze and push services. Also, the emergence of fintech change the financial transaction scope of participant, amount of money, and financial institution environment. However, only 7% of the participants accepted to deposit their money in a fintech in a survey (), which means existing trust problem in FinTechs. Meanwhile, FinTechs implement a strategy of receiving small-volume capital from many small clients, since fintechs are small organizations that accelerate existing banking services. Compared with traditional banking, challenger banks do not have a mass base, but could offer standardized and specialist customer service in certain areas, which has a potential market growth. Therefore, traditional banks participant challenger banks as investors, seeking cooperation on both sides. In this way, traditional banks not only share the financial growth of FinTechs but also boost the innovation in the traditional banking industry, conducive to combining the strengths of all parties. More important, an issue need to be regarded is the privacy risk in fintech. As the network tech developed, data security problem needs to be considered since hackers’ technique is improving and data plays a significant role in the digital era. Plus, the lines between fintech and Big Tech, and traditional platform vendor is blurring.

4.2 Ant Financial Service (Alipay) and TechFin

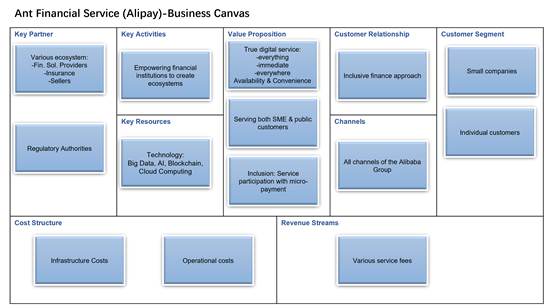

Ant Financial Service as a typical example in TechFin industry, which is a brunch of Alibaba, a big technology group in China. Ant Financial Service as the world’s largest mobile payment platform (Zhao, 2017), using its digital capabilities cultivating its wide customer network in China. Alipay focuses on allowing users to add their services provided from different companies to improve customers’ personalized experience, and attempting to extend Alibaba’s ecosystem power into the banking sector. As a TechFin, Alipay has its strengths in payment area. Alipay could utilize the Alibaba’s customer confidence to build trust among customers, Amazon and PayPal have been regarded as reliable and trustable institutions as banks. Also, Alipay can access to massive customers on Alibaba and collaborated banks. The business canvas of Alipay is shown (Figure 3.).

Figure 3. The Alipay’s Business Model

Source: Author

TechFins are natural rivals of retail banking, so they cooperate with investment banks. Meanwhile, for a technology company, the marginal cost of constructing a TechFin is low, since the digital infrastructure Alipay uses is built by its parent company, Alibaba Group. However, the weakness of TechFins is a lack of financial knowledge to innovate financial products, a way to offset this is establishing some cooperation with banks and FinTechs. Besides, TechFins relies on traditional databases to analyze and operate products, which means less innovation and personal service is happening in TechFins. As Arslanian, & Fischer (2019) stated, TechFin do not need to “become a bank” to disrupt financial services, they need only become a platform for the distribution of financial services.

4.3 FinTech versus TechFin

We can conclude the differences between TechFin and FinTech by the following table (Table 1.).

| FinTech | TechFin |

|---|---|

| 1. Financial service- driven; 2. optimize and innovate financial service; 3. Start-ups; 4. Youngsters, millennial, and professionals preferred; 5. The FinTech’s mission is to provide targeted customers superior experience; 6. Limitation in privacy, cybersecurity and regulatory. |

1. Technology-driven; 2. Improvise the existing banking process; 3. The incumbent, usually big banks participant; 4. Customers prefer legacy and trust; 5. The TechFin’s mission is to enhance proficiency and better existing process by technologies; 6. Huge credit risks. |

Table 1. The Differences between TechFin and FinTech

Source: Author

5. The Future of FinTech and TechFin

Based on the above differences between FinTechs and TechFins, we could understand both sides have their strengths and risks. Fintech provides customized solutions but fail in absorbing fund from public trust to operate huge money. For TechFins, they have had huge brand recognition and popularity but hard to innovate financial solutions. Therefore, cooperating with each other, and learning from each other is a good future trend for TechFin and FinTech to optimize financial operation process and provides better financial products. As Arner et al. (2016) stated, putting the customer experience at the center of financial product is a future-proof strategy.

In my opinion, TechFin is the combined product of traditional banks, big tech and digital innovation in developing countries, which means cooperation among the digital finance industry is a future trend. Not only FinTechs and TechFins should cooperate, all parts including traditional banks should participate in the evolution of FinTech based on their existing reputation, huge accumulated capital power, and rich customer experience. Going forward, the tension between traditional digital financial services and fintech 3.0 providers would around payment, financing, and deposits, especially the deposits point is becoming the strongest contention. To support the development of innovative financial transition, a frame structure should achieve various goals for each candidate in the financial group. Regulators must guarantee to acknowledge the operations to oversee the use of technology in the financial industry. The established bank should compete equally in regulatory burden with FinTech 3.0 companies offering exact or close substitutes for regulated products. Meanwhile, start-ups could operate under these regulatory rules which allows them to progress their business before becoming subject which should pay expensive compliance costs.

6. Discussion

As explained above, financial institutions’ digitalizing their process and services is the main point in the evolution of financial technology. In fact, some fintechs pretended as the technology companies to capture overvalued shares due to the differences and boundary between all financial technology is not significant. However, the development of financial technology must along with defined regulatory implications and obligations refers to the technology usage (Philippon, 2016). The Fintech 3.0 as a non-traditional business model may not fit applicable financial regulations, this lack of regulatory compliance may be active such as a technology company thinking it should not be under the rules and regulations made for banks, or negative such as a company does not know which regulatory it should follow. Therefore, there is uncertain to apply what regulations to constantly emerging new fintech.

For example, the fingerprint scanning tech is the most widespread biometric identification approach used in the digital finance area. However, the fingerprint information could be stolen by a high-resolution photograph. Recently, the 5.6 million fingerprints were filched from the US defence department, and the financial security and personal privacy were under threat (Philippon, 2016).

The solution of regulatory is to cognize the value and benefits for a technology, and balance the view of each party, including the technology industry, financial candidates, regulators etc. (Prigent, 2018). However, the approach could fail to address the evolving business model and market form and new competitive implications, so the regulations should insist neutral principles without shortsighted bias to review the best approach (principle-based rather than rule-based) supporting fintech dynamically.

Meanwhile, stakeholders are interested in transparency and monitoring process in regulatory. The Bank of England (2015), noted that firms started exploiting loopholes of existing surveillance, and highlighted that the specific technologies can add value for regulatory, called RegTech (G. S., 2018), such as Pattern analysis, Big Data, predicting coding tech. These techs can be used to identify unusual patterns of money and available to larger number of inputs than common surveillance techniques. However, balance Regtch benifits and its implication is another issue under discussion referring to fully automatic regulatory.

Also, the way forward may be necessarily setting differences for financial products and periods, and establishing threshold levels about when financial organizations need to obey conduct rules for small candidates, or prudential rules for big actors. This may avoid burdensome regulation with heavy compliance costs and limited benefits for financial stability. Meanwhile, this would help establish the boundary between established banks, FinTech startups, and TechFins.

7. Conclusions

Overall, the differences between FinTech and TechFin could be concluded in terms of their fundamental infrastructure, missions, targeted customers, optimization preferences, and limitations from the external market environment. Also, the sustainable collaboration and competition regulatory model could help financial technology firms survive in a grim competition. No matter what happens, a clear distinguishing rule and the forward-looking regulatory methods are welcome as it makes the financial market efficient and competitive, yielding benefits for the economy and stakeholders (Philippon, 2016), and maximizing the market opportunities. In the future, more models and innovations in regulating differences between different fintech stages and regulatory approaches should be improved.

References

Anon, (2020). Fintech: The History and Future of Financial Technology – The Payments Association. [online] Available at: https://thepaymentsassociation.org/article/fintech-the-history-and-future-of-financial-technology-2/.

Anon, (2021). What Is The Future Of Banking: TechFin Or FinTech? [online] Available at: https://www.cryptovibes.com/blog/2020/07/22/what-is-the-future-of-banking-techfin-or-fintech/.

Arner, D.W., Barberis, J.N. and Buckley, R.P. (2015). The Evolution of Fintech: A New Post-Crisis Paradigm? SSRN Electronic Journal.

Arslanian, H., & Fischer, F. (2019). The Future of Finance: The Impact of FinTech, AI, and Crypto on Financial Services. Springer: Chapter 14 15 18

Awasthi, R. (2022). Techfin Companies Are Advancing Backend Technologies For The Digital Lending Companies. [online] www.ceoinsightsindia.com. Available at: https://www.ceoinsightsindia.com/industry-insider/techfin-companies-are-advancing-backend-technologies-for-the-digital-lending-companies-nwid-2486.html#:~:text=Some%20advantages%20of%20TechFin%20are%3A%201%29Huge%20technological%20companies [Accessed 22 Mar. 2022].

Bada, A. (2020). What is TechFin? Everything You Need to Know. [online] Coinspeaker. Available at: https://www.coinspeaker.com/guides/what-is-techfin/.

Bary, E. (2020, November 18). Visa’s fintech ambitions go beyond pending plaid deal. MarketWatch.

Cho, A. (2016). Artificial intelligence steals money from banking customers. Science.

Don, A. (n.d.). GDPR & FinTechs: A Competitive Advantage? [online] Deloitte United Kingdom. Available at: https://www2.deloitte.com/uk/en/pages/financial-services/articles/is-gdpr-a-competitive-advantage-for-fintechs.html [Accessed 21 Mar. 2022].

Gartner. (2017). Separate Fintech Noise From Reality. [online] Available at: https://www.gartner.com/smarterwithgartner/separate-fintech-noise-from-reality [Accessed 22 Apr. 2022].

Gilbert, N. (2022). 10 Fintech Trends for 2020/2021: Top Predictions According to Experts - Financesonline.com. [online] financesonline.com. Available at: https://financesonline.com/fintech-trends/.

G. S., B. (2018). Are Regtech, Fintech, Blockchain the Future? KnE Social Sciences, 3(2), p.61.

HM Treasury, Bank of England, Financial Conduct Authority (2015). Fair and Effective Markets Review: Final Report - June 2015. [online] Available at: http://www.bankofengland.co.uk/markets/Documents/femrjun15.pdf [Accessed 22 Apr. 2022].

KPMG. (2020). The Pulse of Fintech - KPMG Australia. [online] Available at: https://home.kpmg/au/en/home/insights/2017/04/pulse-of-fintech.html.

Lee (2020). Quantum Finance. Springer Singapore: Chapter 7

Lewis, A. (2021). The Fintech Revolution: Opportunity & Challenges 2021. [online] ReadWrite. Available at: https://readwrite.com/the-fintech-revolution-opportunity-challenges-beyond-2021/ [Accessed 21 Mar. 2022].

Mention, A.-L. (2019). The Future of Fintech. Research-Technology Management, [online] 62(4), pp.59–63. Available at: https://www.tandfonline.com/doi/full/10.1080/08956308.2019.1613123.

Philippon, T. (2016). The Fintech Opportunity. [online] papers.ssrn.com. Available at: https://ssrn.com/abstract=2819862 [Accessed 22 Apr. 2022].

PricewaterhouseCoopers (2017). PwC: 82% of banks, insurers, investment managers plan to increase FinTech partnerships; 88% concerned they’ll lose revenue to innovators. [online] PwC. Available at: https://www.pwc.com/bb/en/press-releases/fintech-partnerships.html.

Prigent, A.-L. (2018). Building a new world for the 21st century… together. OECD Observer.

Puschmann, T. (2017). Fintech. Business & Information Systems Engineering, [online] 59(1), pp.69–76. Available at: https://link.springer.com/content/pdf/10.1007/s12599-017-0464-6.pdf.

Vohra, O. (2020). FINTECH VS TECHFIN: A NEW FORM OF COOPETITION, DETAILED COMPARISON BETWEEN FINANCIAL TECHNOLOGY FIRMS. PEARSON JOURNAL OF SOCIAL SCIENCES & HUMANITIES 2020, [online] 37(7). Available at: https://www.pearsonjournal.com/Makaleler/1188768315_37-49.pdf.

www.bing.com. (2018). Elgin%2c %c4%b0.%2c (2018)Fintech vs TechFin%2c Webrazzi Fintech 2018%2c (Accessed on 25.08.2020). - Bing video. [online] Available at: https://www.bing.com/videos/search?q=Elgin%2c+%c4%b0.%2c+(2018)Fintech+vs+TechFin%2c+Webrazzi+Fintech+2018%2c+(Accessed+on+25.08.2020).&view=detail&mid=80038D2121090C04FB680038D2121090C04FB6D&FORM=VIRE [Accessed 22 Apr. 2022].

Zhao, Y. (2017). Research on the Consumer Finance System of Ant Financial Service Group. American Journal of Industrial and Business Management, 07(05), pp.559–565.

ZHENG, M. (2019). What is FinTech: The Past, Present, and Future. [online] Berkeley Economic Review. Available at: https://econreview.berkeley.edu/what-is-fintech-the-past-present-and-future/.