Question 1

Compare and Contrast Outsourcing with Inhouse production (use ‘ECCO A/S Global Value Chain Management’ case as reference).

1. Introduction

Outsourcing and inhouse production have their own traits. The given case is about a Danish shoe manufacturer ECCO, which has Global Value Chain. ECCO produces 80 percent of its shoes inhouse, the remaining 20 percent outsourced as the shoes cannot benefits from ECCO’s core technology. In discussion part, I will illustrate the definitions about outsourcing and inhouse production, and identify the outsourcing activities and inhouse production based on the given case. Then, I will use ECCO case as reference to compare outsourcing with inhouse production based on the key drivers of sourcing action (McFarlan & Nolan, 1995). Besides, the risks (Aron & Singh, 2005) acts in sourcing decisions and some extra factors should be considered as well.

2. Discussion

Sourcing is defined as contracting or delegating work to an external (outsourcing) or internal (insourcing) entity, both of which could be offshore and onshore. And outsourcing is referring to obtaining the product from outside firms, inhouse is allocating or reallocating the resources within an organization. Insourcing includes Nearshore, Offshore and Captive Centre (Oshri et al., 2015).

Comparison on Key Drivers

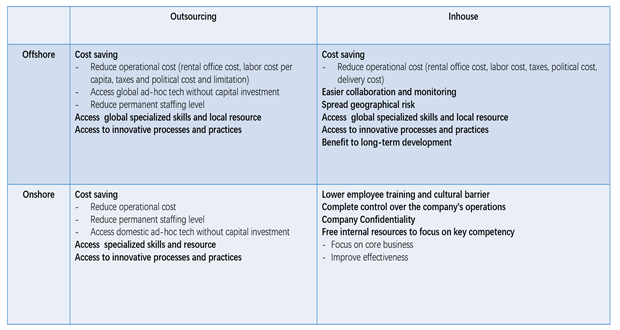

The key drivers of deciding sourcing strategy depend on several perspectives in terms of transaction cost-saving, access to skills and resources, key competency, and access to innovative processes etc. (See details in Appendix 1.) (McFarlan & Nolan, 1995), which means different sourcing approaches have its competitive advantages separately.

Considering ECCO’s philosophy regards quality as the only thing that endures and the product and production technology as core competencies (Feeny et al., 2005), it retains primary cutting-edge production technology in Bredebro (Denmark), and just outsourcing shoes which would not refer to ECCO’s “direct injected” technology. Compared with other brands, ECCO has less outsourcing production considering the following points. First, the core technology is the ECCO’s core competitiveness, a confidential asset for ECCO, which needs to be focused on and protected vitally to guarantee the ECCO’s sustainable development. Second, since ECCO is owned by the family ownership, onshore inhouse production could help head office completely control the company’s operations and make decisions swiftly. Besides, ECCO could benefit from its local resource in Denmark as the origin of ECCO is Denmark. Also, as the five largest producers of leather worldwide, ECCO has to be self-sufficient or inhouse production since its high demands on quality and lead time.

Based on ECCO’s establishing manufacturing facilities globally experience, labour cost saving is an essential reason for offshore sourcing. The GDP per capita in the ECCO oversea production countries is much lower than that in Denmark, according to de Soyres & Gaillard (2022), enterprises just need to pay the employee at a local level. Through case studies, as a technology-oriented enterprise, offshoring could help ECCO access to global top skills and local marketing. For instance, ECCO moved part of the production to Portugal, which held a leading position in the production of uppers and shoe assembly, and made the Portuguese unit the laser-tech leading developer in ECCO. Thais’ good eye for small details also helps ECCO deliver first-class workmanship. Besides, offshoring benefits innovative processes, and the ECCO’s research and development aspect relocated to the production sites to support the optimization of materials. Also, offshoring production could spread geographical risk, such as a multi-region layout could decrease business risk due to lockdown during the pandemic period.

The original purpose of outsourcing is producing expenses reduction and increase flexibility, resulting in a higher profit margin in fierce competition. Companies such as Clarks and Timberland have become marketing-oriented business models like Nike, while Timberland produces about 10 percent of its shoes inhouse, and Clark had completely outsourced its production. Above outsourcing actions is because shoe manufacturing is labour intensive, and the wage level is of paramount importance, which is a main component of cost. Also, maintaining core business inhouse and outsourcing production parts helps Clarks and Timberland’s team keep attention on their essential competency. However, it is critical to select the appropriate location for offshoring activities (Rottman and Lacity, 2006). As charts showed, ECCO’s operating margin decreased rapidly during 2000-2004, as the average labour cost increased in Portugal. Outsourcing can help entity obtain a product without capital investment. Meanwhile, outsourcing could help marketing-oriented companies reach marketing naturally, but circumventing sudden shifts in customer tastes is another concern in marketing development. Also, Timberland believes that outsourcing could refine production techniques, planning efficiencies and lead time reduction. However, outsourcing is not efficient for the family ownership ECCO, since it can choose and decide the right thing for its global value chain timely with inhouse production. Also, outsourcing exists leaking confidential information and technique risks. Companies generally outsource independent and non-core services, which is a popular management strategy. However, over outsourcing could cause the entity cannot control each stage price in the value chain and respond to price slowly, such as Timberland’s gross margin was negatively affected by increases in the cost of leather as the selling price did not increase proportionally. Compared with other brands, ECCO can respond quickly to market change since its vertically complete insourcing production and development chain. Meanwhile, monitoring material standards and product quality, employee turnover rate and employee satisfaction become enormous tasks in outsourcing development. As outsourcing provides cheaper products for customers but potentially increased unemployment at home as domestic workers are crowded out of the labour market by a more competitive labour market, which is another point needs to be concerned.

Comparison on Risks

According to Aron & Sing’s (2005) research, risks (including operational risk and structural risk) is existing in a company when making sourcing decisions, and both risks should be concerned jointly and managed in insourcing. The operational risk is critical in the initial stage of the offshoring or outsourcing process, but the structural risk would swell in a long term. Operational risk is to evaluate prosses smooth level after offshored, which depends on two dimensions, precision of metrics used to measure process quality, and codifiability of work. Structural risk is to evaluate the match level of service providers’ work as expected. Based on their study, companies should offshore the service or product with high precision and easily codified. Corresponding to the case, ECCO onshoring the shoe production with cutting edge technology, and new articles and prototype testing part, designing and developing products, which is the hardest part to codify in ECCO production, also it is difficult to measure workload. Constantly, ECCO offshore the shoe and tannery factor which is a relatively mature process in production. However, ECCO is plagued by Chinese manufacturers copying the ECCO design, they have to use a special unit of attorney at ECCO to protect the brand and design. Clarks and Timberland outsource most of the production process since they regard brand marketing as a core competency, and they did lots of work in monitoring production to decrease structural risk, containing setting up a quality group, purchasing leather from 60 suppliers who are subject to rigid quality controls, Timberland probably believes that monitoring production is easier than producing itself. However, companies should make sourcing decisions by judging three aspects, core competency, long-term management and sustainable development. Although some products or service is easy to codify, we still need to keep them onshore because it is not sustainable. For example, a service is not popular worldwide, so we cannot gain a lower cost and market present offshore, which is not beneficial to the entity’s sustainable development. In addition, if a service is easy to codify and monitor, but this service is core, the entity should hold it as it is a core competency.

3. Conclusion

Outsourcing and inhouse production are different sourcing management strategies, which could affect entities’ profit and influence the long-term development of manufacturers. Nowadays, outsourcing is used increasingly for its cost-saving, access to top techniques and markets without capital investment, and benefits to the innovative process. According to these reasons and lots of entities’ experience, outsourcing becomes a significant sourcing approach for companies to consider. However, in-house production still is a good choice for ECCO since it benefits company confidentiality and technology development, and helps ECCO control the global value chain efficiently. As above, companies should optimize the value chain constantly, and be concerned about the global economic situation to adjust their sourcing management strategy flexibly.

Question 2

ECCO has production facilities in Portugal, Slovakia, Indonesia, China, Thailand etc.

Do you recommend ECCO to go with Multisourcing? Why/Why not?

1. INTRODUCTION

Multisourcing is becoming the dominant sourcing trend, driven by client organizations that contract more with suppliers. Although multisourcing could help clients get the best supplier in a large scape, improve adaptability and agility to a dynamic environment (Cohen and Young, 2006; Dedrick and Kraemer, 2011)), and mitigate the risks of single supplier (Bapna et al. 2010), it increased transaction costs since clients have to manage more suppliers (Oshri & Willcocks, 2014). As Bapna et al. stated, codevelopment work undertaken by multiple parties is impossible to measure contribution and interests, no contracts can be built on them (Bhattacharya et al. 2014). Combining the ECCO’s precise positioning, main market diversion and its attention on the entire value chain, multisourcing is imperative but progressive.

2. DISCUSSION

Previous research proposed that outsourcing is due to the cost-efficiency forming from flexibility and specialization (Huber, 2008). The modularity of the outsourced tasks (Aron et al. 2005; Herz et al. 2011), vendor competition landscape (Flinders 2010), professional extend and coordination costs (Bapna et al., 2010) all should be considered in sourcing management. ECCO as a manufacturer employs nearly 10,000 people and works with 34 partnerships in 2004, and it is the second-largest footwear brand in global sales shown in charts, ECCO holds most of the asset ownership. It is significant for ECCO to value the brand and increase possible advantages in considering the approach to establishing sourcing structure.

Product is priority in ECCO.

ECCO is engaging in the shoe-manufacturing industry, which lacks top-skill generally. In manufacturing industry, the elite talents is scarce and need to be regarded as an essential asset especially aiming to an entity putting technology, knowledge on the first principle. ECCO emphasises employees with international mindsets and adaptability skills (Boudreau & Lakhani, 2013), providing vocational training, developmental conversations and academic progress. Employee training is a helpful strategy for individual development, organizational progress, and forming ECCO’s culture.

ECCO’s supply chain is unique since it owns completely supplying assets compared with other brands. However, it is a massive workload for the head office to manage ECCO’s complex supply network containing over 200 raw material lines, according to Phillips. As a result, ECCO outsourced marginal business in recent years to guarantee itself concentrating on technology and quality development. Past, ECCO started foreign planting and performed volume production, transforming to split up the research sector and revolve at the product sites. The success of ECCO owned to ECCO applying producer specialization and cutting-edge technology in practicing timely (Sun et al., 2020)

Optimal logistic transportation utilizing cloud tech could enhance entities’ adaptability and agility to the dynamic environment (Cohen and Young, 2006). Placing production data, inventory data and delivery data into a cloud database and utilizing algorithms improve operational efficiency probably can decrease distribution costs. The distribution system based on a bar code system could be replaced by a predictable and help-manage system on cloud computing and data (Sarea & Taufiq-Hail, 2021). Employees could post their developed ideas and innovative business ideas on a cloud platform to build a feedback mechanism in the company to assist management. Also, suppliers’ information could be updated on the cloud, structuring standard flow and coordinating with partnership flexibility. A regular updating system could enhance entities’ adaptability in more dynamic scenarios. However, an efficient logistics management system may lead to an increase in short-term costs, but is conducive to the sustainable development of the entity.

Marketing opportunity is increasingly crucial.

From 1999 to 2003, ECCO experienced stagnating productivity and an operating margin decline from 15 percent in 2000 to 5 percent in 2002. These apparencies request ECCO further streamline logistics, monitor the market, shape the brand. As Thinghuus commented, ECCO may need to become better at telling stories in marketing, instead of expecting the unique tech will last. However, as the chart shows, although ECCO is the second largest footwear sale globally, new source of market growth cannot be ignored as the fourth company had about 58% global sale increase in 2002. Therefore, ECCO’s whole value chain should be concerned, such as establishing factories in China could extend all semi-product and product markets. Data technology also should be applied in marketing, collecting customers’ purchase data could understand clients’ preferences, and guide manufacturers’ marketing prediction and development (Dellarocas, 2010).

If the task is highly modular, the multisourcing performs better than single-sourcing, at least not worst (Bhattacharya & Hasija, 2018). For ECCO operation, the production process is relative modular, and can be divided into five strategic phases and located in offshoring locations organizationally. Compared with other marketing-oriented companies, they usually divide business into marketing and production, and relative modular their marketing. As a result, ECCO should pay attention to modularizing the remaining marketing business to create new competitive advantages since its production is completely modular than competitors. However, a smarter modularity approach should be proposed to increase value (Farrell, 2006), such as splitting the marketing sector to an offshoring location, which could combine the partnership’s marketing knowledge and local position with ECCO’s strong band and quality. Aibu and ECCO coordination in China is a good start for ECCO’s marketing sourcing.

Multisorcing is inevitable trend.

Single-sourcing could decrease the coordinate cost but high-quality risk as no one can understand all fields, so management operational steps assisting technology is important (Levina & Ross, 2003). Besides, single-sourcing could leak to monopoly suppliers with high bargaining power, and it has a high moral hazard. A combined sourcing strategy could cause high cost efficiency, and focus on the entity’s right and suitable developing path.

ECCO entered North America and turned its eyes to the Asian market by establishing foreign facilities, consolidating brand position producing men’s segment. Globalization is a long-term goal for ECCO to broaden the global market by deepening and widening services in many global markets. Considering the broaden global market and ECCO’s long-term sustainable development, multisourcing is conductive to get greater market and brand awareness. Furthermore, ECCO could pay attention to developed regions and counties to establish more sales channels. Another point should be mentioned is that entity’s culture is a key asset which could increase corporate identity. ECCO emphasises continuous education and comprehensive common culture, which can solve the multi-culture issues due to multisourcing. Going forward, ECCO should educate employees to elevate self-worth, and keep up with the time.

3. CONCLUSION

Multisourcing is a beneficial approach to ECCO but smarter modularity and management strategy is a point that need to be developed and became the next competitive advantage as a footwear manufacturer. Smarter internal modularity could decrease responsibility disputes and coordinate cost, better concentrating on key competency, though vertical global value chain has made interests for ECCO, a stronger supply chain management strategy could develop core skills furthermore. It is important to optimize organizational core value by utilizing positive sourcing approaches and advanced technology.

References

Aron, R. and Singh, J.V. (2005). Getting offshoring right. Harvard business review, 83(12), pp.135–43.

Bapna, R., Barua, A., Mani, D. and Mehra, A. (2010). Research Commentary—Cooperation, Coordination, and Governance in Multisourcing: An Agenda for Analytical and Empirical Research. Information Systems Research, 21(4), pp.785–795. doi:10.1287/isre.1100.0328.

Bhattacharya, S., Gupta, A. and Hasija, S. (2018). Single sourcing versus multisourcing: The roles of output verifiability on task modularity. MIS Quarterly, 42(4), p.1171.

Boudreau, K. J., and Lakhani, K. R. (2013). “Using the Crowd as an Innovation Partner,” Harvard Business Review (91:4), pp. 60-69.

Cohen, L. and Young, A. (2006). Multisourcing : moving beyond outsourcing to achieve growth and agility. Boston, Mass.: Harvard Business School, Cop.

de Soyres, F. and Gaillard, A. (2022). Global trade and GDP comovement. Journal of Economic Dynamics and Control, 138, p.104353. doi:10.1016/j.jedc.2022.104353.

Dedrick, J., Carmel, E. and Kraemer, K.L. (2011). A Dynamic Model of Offshore Software Development. Journal of Information Technology, 26(1), pp.1–15. doi:10.1057/jit.2009.23.

Dellarocas, C. (2010) The Collective Intelligence Genome, Sloan Management Review, Spring 2010, 5, 3, 21-31

Farrell, D. (2006). Smarter offshoring. Harvard business review, 84(6), pp.84–92.

Feeny, D., Lacity, M. and Willcocks, L.P. (2005). Taking the measure of outsourcing providers. MIT Sloan management review, 46(3), p.41.

Flinders, K. 2010. “IT Buyers Turn to MultiSourcing,” Computer Weekly, December 14.

Huber, B. 2008. “Agile Multi-Sourcing: A Critical Business Trend-Concepts and Background,” White Paper, Technology Partners International: Information Services Group.

Levina, N. and Ross, J.W. (2003). From the Vendor’s Perspective: Exploring the Value Proposition in Information Technology Outsourcing. MIS Quarterly, [online] 27(3), pp.331–364. doi:10.2307/30036537.

McFarlan, F.W. and Nolan, R.L. (1995). How to manage an IT outsourcing alliance. MIT Sloan Management Review, 36(2), p.9.

Oshri, I., Kotlarsky, J. and Willcocks, L. (2015). The handbook of global outsourcing and offshoring : the definitive guide to strategy and operations. Basingstoke: Palgrave Macmillan.

Oshri, I. and Ravishankar, M.N. (2014). On the attractiveness of the UK for outsourcing services. Strategic Outsourcing: An International Journal, 7(1), pp.18–46. doi:10.1108/so-11-2013-0022.

Oshri, I. and van Uhm, B. (2012). A Historical Review of the Information Technology and Business Process Captive Centre Sector. Journal of Information Technology, 27(4), pp.270–284. doi:10.1057/jit.2012.26.

Rottman, J.W. and Lacity, M.C. (2006). Proven practices for effectively offshoring IT work. MIT Sloan management review, 47(3), p.56.

Sarea, A., & Taufiq-Hail, G. A. M. (2021, March). Evaluation of compatibility of cloud-based applications, credibility, and trust perceptions on the adoption of cloud technology: A review. In International Conference on Advanced Machine Learning Technologies and Applications (pp. 889-907). Springer, Cham.

Sun, Y., Bi, K. and Yin, S. (2020). Measuring and Integrating Risk Management into Green Innovation Practices for Green Manufacturing under the Global Value Chain. Sustainability, 12(2), p.545. doi:10.3390/su12020545.

Appendix 1

The Key Drivers of Outsourcing and Inhouse production (Offshore and Onshore)

Source: Author